monterey county property tax rate

Enter the bill year. Pay Real Estate Taxes Online.

Effective tax rate Monterey County 00070 of Asessed Home Value California 00076 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Monterey County 3611 California 3818 National 2471 Median home value Monterey County 516600 California 505000 National 217500 Median income Monterey County.

. Search Valuable Data On A Property. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes finesfees banking and investment services. Enter the bill number of your current bill.

Salinas California 93901. All major cards MasterCard American Express Visa and Discover are accepted. General Law or Chartered Per 1000 Property Value City Rate Revenue.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. What is the sales tax rate in Monterey County. District 2 - John M.

The assessors office can provide you with a copy of your propertys most recent appraisal on request. 1-831-755-5057 - Monterey County Tax Collectors main telephone number. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300.

1-800-491-8003 - Direct line to ACI Payments Inc. If you wish you may pay both the third and fourth quarter by entering that amount from your bill. The tax amount shown is the amount of the third quarter due Feb 1.

So if your home is valued at 1000000 the transfer tax would be 1100. A convenience fee is charged for paying with a CreditDebit card. 30 out of 58 counties have lower property tax rates.

Also asked how much is the property tax in California. Post Office Box 390. The 2018 United States Supreme Court decision in South Dakota v.

The Monterey County Assessors Office located in Salinas California determines the value of all taxable property in Monterey County CA. Credit Card Payments - 225 of the total tax bill All service fees are assessed by our credit card vendor not the County of Monterey Both numbers listed below offer service in English or Spanish. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

168 West Alisal Street. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Yes you can pay your property taxes by using a DebitCredit card.

Click to see full answer. Monterey County Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you arent focused on your property levy being higher than appropriate according to your propertys real value. Calculation of Taxes Page 5 Property Tax Highlights FY 2020-21 Once the Assessor has finalized the assessment roll it is provided to the Auditor-Controller on or before July 1st.

Monterey County collects on average 051 of a propertys assessed fair market value as property tax. Tax bills are generated every fiscal year July 1 through June 30 and mailed in mid-October and payment may be made in two. The California state sales tax rate is currently 6.

The Monterey County sales tax rate is 025. This is the total of state and county sales tax rates. 26 counties have higher tax rates.

Start Your Homeowner Search Today. Monterey County has one of the higher property tax rates in the state at around 1095. Monterey County Transfer Taxes.

Each TRA is assigned a six-digit numeric identifier referred to as a TRA number. Alisal St 3rd Floor. Tax Rate Areas Monterey County 2021 A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900.

What triggers a transfer tax. Note that 1095 is an effective tax rate estimate. Such As Deeds Liens Property Tax More.

The Monterey County Association of REALTORS promotes professionalism property rights and home ownership. District 5 - Mary Adams. Our Monterey County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States.

Monterey County Treasurer-Tax Collectors Office Suggest Edit. District 1 - Luis Alejo. District 4 - Wendy Root Askew.

The Monterey County Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. Go to the homepage. Ad Get In-Depth Property Tax Data In Minutes.

The minimum combined 2022 sales tax rate for Monterey County California is 775. For credit cards the fee is 225 of the total amount you are paying. Average Property Tax Rate in Monterey Based on latest data from the US Census Bureau Monterey Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may not know that your real estate tax is set too high in relation to your homes fair market value.

Clerk of the Board. The property tax rate used by the Auditor-Controller include. Ad Find Out the Market Value of Any Property and Past Sale Prices.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund. Secured property taxes are levied on property as it exists on January 1st at 1201 am. Complete the payment screens as directed.

That means the state levies a transfer tax of 055 per every 500 of home value. The Auditor-Controller then calculates the property taxes due by parcel and its assessed val-ue. For E-Check a flat fee of 025 is charged.

A transfer tax is imposed on documents that show an interest in property from one person to another person. District 3 - Chris Lopez. Property Tax in Monterey County.

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Monterey County Home Prices Market Trends Compass

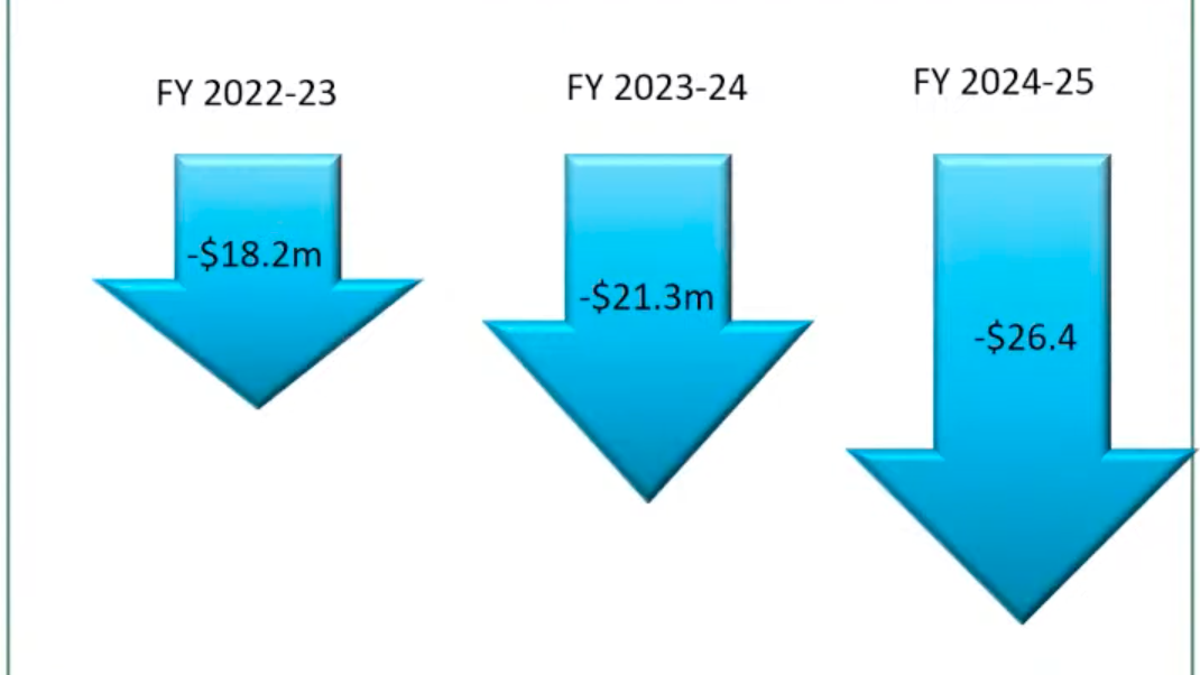

Monterey County Begins Its Annual Budget Talks With A Projected Deficit News Montereycountyweekly Com

The California Transfer Tax Who Pays What In Monterey County

Calfresh Monterey County 2022 Guide California Food Stamps Help

Secured Property Tax Monterey County Ca

Property Tax By County Property Tax Calculator Rethority

Additional Property Tax Info Monterey County Ca

Property Tax By County Property Tax Calculator Rethority

Riverside County Ca Property Tax Search And Records Propertyshark

Does Monterey County Have Enough Hotel Rooms And Other Visitor Lodging Options Without Str S Will Further Proliferation Of Vacation Rentals Impair Community Character Preserve Monterey Neighborhoods Community